Calculating Customer Acquisition Cost: The Ultimate Guide

Calculating Customer Acquisition Cost: The Ultimate Guide

Beyond The Basics: Why CAC Makes Or Breaks Your Business

Calculating customer acquisition cost (CAC) is more than just crunching numbers. It's a fundamental indicator of your business's health and potential for sustainable growth. This metric reveals how efficient your marketing and sales efforts are. It directly impacts your bottom line, valuation, and how you stand against the competition.

A high CAC can quickly drain your resources. On the other hand, a low CAC can free up capital for reinvestment and expansion. Understanding and optimizing your CAC is crucial for long-term success.

The Impact of CAC on Business Decisions

Leading companies use CAC in conjunction with customer lifetime value (LTV). The CAC-to-LTV ratio provides a powerful lens for evaluating the long-term profitability of acquiring new customers.

A healthy ratio (generally considered 3:1 or higher) means the value generated by a customer over their relationship with your business significantly outweighs the cost of acquiring them. This knowledge empowers businesses to make informed decisions about:

- Channel investments

- Growth timing

A deep understanding of CAC allows you to spot warning signs. For example, you can identify unsustainable marketing initiatives that appear promising on the surface but actually erode value over time.

Customer Acquisition Cost (CAC) varies significantly by industry. This reflects diverse market dynamics and customer behavior. For example, SaaS companies typically experience an average CAC of around $205, positioning them in the median range.

- Education: $862

- Financial Services: $640

- Online Marketing: $87

- Business Consulting: $410

This variation underlines the importance of industry context when calculating and interpreting CAC. A critical benchmark for assessing CAC efficiency is the customer lifetime value (LTV) to CAC ratio, where a ratio of 3:1 or higher is generally considered healthy. This ratio helps businesses evaluate whether their investment in acquiring customers is sustainable and profitable. Find more detailed statistics here: Vena Solutions

Driving Strategic Alignment With CAC

CAC is a powerful tool for aligning different departments within your organization. By making CAC a shared metric across finance, marketing, and sales, you create a culture of accountability and shared responsibility for growth.

This fosters collaboration and ensures everyone is working towards the same goal: acquiring customers efficiently and profitably. This shared understanding is crucial. Through consistent monitoring and optimization of CAC, your business can build a solid foundation for sustainable growth and market leadership.

Calculating Customer Acquisition Cost: A Framework That Works

Calculating your customer acquisition cost (CAC) is more than just plugging numbers into a formula. It's a vital process for understanding your business's profitability and potential for growth. Instead of relying on simple online calculators, growth-minded companies use a more thorough approach. This involves carefully considering all expenses and strategically allocating costs such as marketing team salaries, tech investments, and content creation. This framework not only measures your current CAC, but also helps you optimize it for future success.

Defining Your Scope and Identifying Costs

The first step is defining the timeframe for your CAC calculation. Choose a period that aligns with your business cycles – monthly, quarterly, or annually. Consistency allows for accurate comparisons over time and reveals important performance trends. Next, identify all costs directly tied to acquiring new customers within that timeframe. This includes obvious expenses like advertising, but also often-overlooked costs.

Some common costs include:

- Marketing Team Salaries: Allocate a portion of salaries based on time spent on customer acquisition.

- Software & Tools: Include costs for CRM, analytics platforms, marketing automation, etc.

- Content Creation: Factor in expenses for blog posts, videos, and other marketing materials.

- Overhead: Consider a portion of rent, utilities, and other shared operational expenses.

Handling Tricky Allocation Questions

Accurately allocating indirect costs can be a challenge. How much of your marketing team's salary is truly for acquisition versus retention? One common approach is to estimate the percentage of their time spent on acquisition-focused activities. The same logic applies to shared resources like software subscriptions and office space. This proportionate allocation ensures a more accurate CAC calculation.

Time-Period Analysis and Avoiding Misalignment

Proper time-period analysis is essential. Your cost and customer acquisition data must be aligned within the chosen timeframe. For example, if calculating monthly CAC, don't include marketing spend from the previous month that resulted in customers acquired this month. This misalignment can obscure true performance and lead to poor decisions. Learn more about accurate measurement in this article about How to master marketing campaign success.

Channel-Specific CAC and Benchmarking

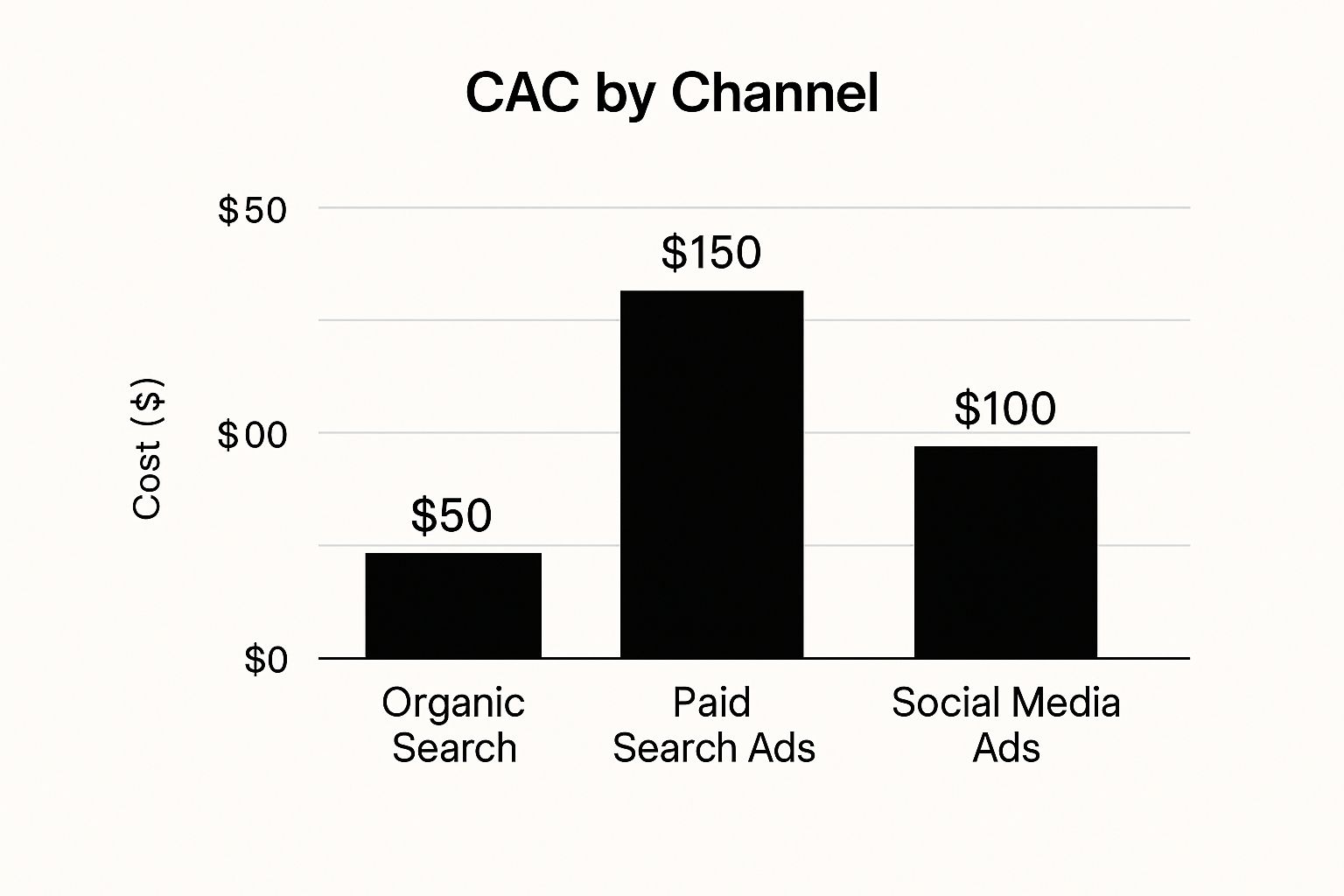

Calculating CAC by channel offers invaluable insights. This lets you compare the effectiveness of different acquisition strategies and pinpoint your most profitable channels. The infographic below shows average CAC across three common channels:

Organic search has the lowest CAC at $50, followed by social media ads at $100, and paid search ads at $150. This demonstrates the potential cost-effectiveness of organic strategies, while also showing the value of paid channels for targeted reach. For more on maximizing ROI, check out this article: How to master ROI strategy. Understanding channel-specific CAC empowers you to make data-driven decisions about budget allocation and channel optimization.

To further break down the components of CAC calculation, let's look at the following table.

To further understand how to calculate CAC across various business models, refer to the table below:

CAC Calculation Components Breakdown This table breaks down all the components that should be included when calculating customer acquisition cost, with examples for different business types.

| Cost Component | Description | B2B Example | B2C Example | SaaS Example |

|---|---|---|---|---|

| Marketing Team Salaries | Portion of salaries dedicated to acquisition | Sales team salaries, marketing manager salary | Social media manager salary, content creator salary | Growth marketing team salaries, content marketing salaries |

| Software & Tools | Costs for CRM, analytics, marketing automation | Salesforce, HubSpot, Marketo | Mailchimp, Hootsuite, Google Analytics | Intercom, Segment, Drift |

| Content Creation | Blog posts, videos, social media content | White papers, case studies, webinars | Social media posts, influencer marketing, video ads | Blog posts, ebooks, webinars |

| Advertising Spend | Paid campaigns on various platforms | LinkedIn ads, Google Ads, industry publications | Facebook ads, Instagram ads, TikTok ads | Google Ads, Capterra, social media ads |

| Overhead | Portion of rent, utilities, other shared expenses | Office rent, utilities, IT support | Warehouse space, utilities, customer service software | Server costs, office rent, customer support salaries |

This table demonstrates how different business models prioritize various cost components when calculating CAC. While marketing team salaries and software tools are consistent across the board, other areas like advertising spend and overhead can vary significantly. Understanding these nuances allows for a more accurate and insightful CAC calculation.

Industry Benchmarks: Where Your CAC Should Really Stand

Understanding your customer acquisition cost (CAC) is essential for any business. But knowing the number isn't enough. You also need to know how your CAC compares to others in your industry and, more importantly, how it fits within your own business context. This requires looking beyond general averages and considering the specific factors that influence your unique business model and stage of growth.

Benchmarking CAC by Industry and Growth Stage

Industry averages provide a helpful starting point for evaluating your CAC. However, a fast-growing startup will likely have a different CAC than a well-established company in the same industry. For example, a SaaS company in its early stages may accept a higher CAC to prioritize rapid growth, expecting that customer lifetime value (LTV) will eventually exceed the initial acquisition costs. They're investing in gaining market share. In contrast, a mature SaaS business may focus on optimizing profitability and strive for a lower CAC.

Different industries also have different CAC benchmarks. This is due to inherent differences in sales cycles, customer lifetime value, and the competitive landscape. Industries with longer sales cycles and higher LTVs, such as enterprise software, tend to have higher CACs than industries with shorter sales cycles and lower LTVs, such as e-commerce.

Identifying Sustainable CAC Targets

Instead of chasing industry averages, focus on setting sustainable CAC targets aligned with your specific business goals. A key metric is your LTV:CAC ratio. A ratio of 3:1 or higher is generally considered healthy. This signifies that the value generated by each customer substantially outweighs the cost of acquiring them. However, this ratio can fluctuate based on factors like your business model and funding strategy. For a more detailed understanding of calculating CAC and its impact on ROI, check out this resource: Customer Acquisition Cost Formula: Mastering ROI Strategy.

Recognizing Warning Signs and Opportunities

Even if your CAC appears reasonable compared to industry benchmarks, there can be signs that it might be unsustainable. For example, a steadily increasing CAC coupled with declining conversion rates could indicate market saturation or ineffective marketing campaigns. Conversely, a high LTV significantly exceeding your CAC, with growth limited by acquisition spending, could suggest an opportunity to increase spending and accelerate growth while maintaining profitability. It's all about striking a balance between acquiring customers aggressively and spending sustainably.

Analyzing CAC by channel is another vital aspect. Some channels naturally have higher CACs than others. Paid advertising, for instance, may have a higher CAC than organic search. However, paid advertising might also deliver higher-value customers or faster results. Understanding the channel economics helps you optimize your channel mix and allocate your budget effectively.

The Rising Cost Crisis: Why CAC Is Climbing Everywhere

The world of digital marketing is always changing, and one of the biggest changes is the rising cost of getting new customers. This cost, known as customer acquisition cost (CAC), has gone from a manageable expense to a major challenge for businesses big and small. This isn't a temporary problem; it's a fundamental shift happening for several reasons.

The Forces Driving Up CAC

One major factor is how online platforms are changing. Algorithm updates on platforms like Google, Facebook, and Instagram often give preference to paid content, making it harder to reach people organically. This pushes businesses to spend more on advertising to reach their target audience. Increased privacy rules, like GDPR and CCPA, also limit the data available for targeted ads, making campaigns less effective and more expensive.

The digital advertising space is also much more crowded now. With more businesses competing for the same online attention, ad prices have naturally increased. This competition creates a bidding war that inflates CAC, especially in popular industries. This means businesses need smarter strategies for their ad spending to keep CAC reasonable. You might find this helpful: How to master marketing ROI measurement.

Consumer behavior is changing, too. Today's consumers expect more personalized experiences and engaging content. This means businesses have to invest more in advanced marketing strategies and technologies to get their attention, which also raises CAC. Things like personalized email campaigns, interactive content, and retargeting can all increase CAC, but they also boost conversion rates.

Looking back at CAC over the past decade, we see a sharp rise. Research shows that over the last eight years, CAC has jumped by about 222%. In 2013, brands lost an average of $9 for every new customer. More recently, that loss has grown to $29 per new customer. Acquiring new customers is still 5 to 25 times more expensive than keeping existing ones. Even with this higher cost, almost 44% of companies focus on getting new customers, while only 18% focus on retention. Yet, existing customers contribute about 65% of revenue, compared to 35% from new customers. Learn more about these statistics here: Inbeat Agency.

Adapting to the New Reality

The rising CAC means businesses need to fundamentally change how they approach growth. Just spending more on ads isn't sustainable anymore. Companies need to prioritize efficiency, data-driven decisions, and a holistic approach to customer acquisition. This means optimizing conversion rates, targeting high-value customers, and using a variety of acquisition channels.

Channel Economics: Finding Your CAC Sweet Spots

Not all customer acquisition channels are created equal. Some channels will deliver high-value customers at a low cost, while others may not provide a good return on investment. Understanding these channel economics is key to optimizing your customer acquisition cost (CAC) and getting the most out of your marketing budget. This involves analyzing channel-specific data, understanding attribution models, and recognizing when a channel has become saturated.

Analyzing Channel Performance

To really understand your channel economics, you need to look beyond simple last-click attribution. Many businesses make the mistake of only giving credit to the last channel a customer interacted with before making a purchase. However, the customer journey is often more nuanced. A customer might discover your product through organic search, then interact with a social media ad, and finally convert after receiving an email.

A robust attribution model, like a multi-touch attribution model, distributes credit across all touchpoints. This helps accurately assess the true contribution of each channel.

Check out this guide on marketing channel performance for a deeper dive into this topic. Optimizing individual channels can maximize conversion rates and lower your CAC.

Customer acquisition costs also vary significantly by channel and region. For instance, acquiring mobile app users is often expensive. In 2020, the global average cost to acquire an in-app buyer was $74.68, while mobile app subscriptions cost businesses around $64.27 per user. You can find more detailed statistics here: First Page Sage. This emphasizes the importance of carefully measuring and optimizing your mobile acquisition strategy and balancing it with more cost-effective channels like organic marketing.

To help visualize the differences in CAC across various digital marketing channels, let's look at the following comparison table. This table presents average CAC, typical conversion rates, ideal use cases, and potential limitations for each channel.

| Marketing Channel | Average CAC | Typical Conversion Rate | Best For | Limitations |

|---|---|---|---|---|

| Paid Search (Google Ads) | Varies greatly, can be high | 2-5% | Driving immediate sales, targeting specific keywords | Can become expensive, requires constant optimization |

| Social Media Advertising (Facebook, Instagram) | Generally lower than paid search | 1-3% | Brand awareness, reaching specific demographics | Requires engaging content, can be difficult to track ROI |

| Email Marketing | Very low | 2-4% | Nurturing leads, building relationships | Requires building an email list, can be seen as spam |

| Organic Search (SEO) | Low, primarily time investment | Difficult to measure directly | Building long-term brand authority, driving organic traffic | Takes time to see results, requires ongoing effort |

| Content Marketing (blogging, articles) | Low to moderate | Difficult to measure directly | Educating potential customers, establishing thought leadership | Requires high-quality content, takes time to build an audience |

This table provides a general overview and specific CAC figures can vary depending on factors like industry, target audience, and campaign specifics. It highlights that channels like email and organic search tend to offer lower CAC, while paid search and social media advertising can be more expensive. Understanding these differences is crucial for allocating your marketing budget efficiently.

Recognizing Channel Saturation

As you increase spending on a particular channel, you may reach a point of diminishing returns. This is channel saturation. Your CAC will begin to rise as it becomes more difficult and expensive to acquire new customers through that channel. Recognizing early signs of saturation is critical.

These signs can include declining conversion rates, increasing cost-per-click (CPC), and a plateauing or decreasing number of new customers acquired through the channel. By monitoring these metrics, you can identify saturation before your CAC increases dramatically. This proactive approach lets you adjust your strategy and explore new channels.

Balancing Your Channel Portfolio

Successful companies diversify their channel mix. They balance their portfolio between established, high-performing channels and experimental, emerging channels. This balanced approach allows them to optimize for both short-term results and long-term growth potential. By allocating a portion of their budget to experimentation, they can discover new, cost-effective acquisition sources before their existing channels become saturated. This continuous exploration and optimization are essential for maintaining a sustainable and efficient customer acquisition strategy.

Powerful CAC Optimization Tactics That Actually Work

Optimizing your Customer Acquisition Cost (CAC) is crucial for sustainable business growth. It's not enough to simply calculate your CAC; you have to actively reduce it while keeping a high Customer Lifetime Value (LTV). This means strategically re-evaluating your entire acquisition process, from initial targeting and conversion rate optimization to the onboarding process and long-term customer engagement. Optimizing CAC involves effective demand generation. Learn more about Demand Generation Campaigns.

Refining Your Targeting and Messaging

One of the most effective ways to lower your CAC is to refine your targeting. By concentrating your efforts on the most qualified leads, you'll reduce wasted ad spend and boost your conversion rates. This requires a thorough understanding of your ideal customer profile.

Develop detailed buyer personas to understand your target audience's needs, pain points, and preferred communication channels. This information will allow you to tailor your marketing campaigns more effectively.

Tailor your messaging to connect with each segment. Generic messaging often fails to resonate. Instead, speak directly to the specific challenges and desires of your target audience. This personalized approach builds trust and improves engagement, leading to better conversion rates and a lower CAC.

Optimizing Your Conversion Process

A smooth and user-friendly conversion process is key to minimizing CAC. Analyze your current conversion funnel and identify any obstacles. Simplify forms, optimize website navigation, and use clear calls to action.

A/B testing can help you determine what resonates best with your target audience. Google Optimize is a popular tool for A/B testing. For instance, even small changes like adjusting a button's color or rephrasing a call to action can have a big impact. These small wins add up over time, resulting in a significant CAC reduction.

Leveraging the Power of Referrals

Referral programs are a powerful tool for lowering CAC. Satisfied customers are your best advocates. By encouraging them to refer new customers, you tap into a cost-effective acquisition channel.

A well-designed referral program creates a positive feedback loop. Happy customers bring in new customers, reducing your overall acquisition costs. Referrals also tend to bring in higher-quality leads, who are more likely to convert into long-term customers.

Enhancing Onboarding to Boost Conversions

Onboarding is vital for turning new customers into loyal users. A positive onboarding experience solidifies their purchase decision and lays the foundation for a strong relationship.

Provide helpful resources, personalized support, and proactive engagement during the initial stages. This increases customer satisfaction and reduces churn, lowering your CAC and boosting your LTV. This is especially important for SaaS businesses, where ongoing engagement is essential for success.

Building Sustainable Acquisition Advantages

Look beyond paid channels and explore sustainable acquisition strategies that yield long-term results. Investing in quality content marketing, cultivating engaged communities, and developing strategic partnerships can create lasting acquisition advantages.

While these strategies may not provide immediate results like paid advertising, they build brand authority, drive organic traffic, and nurture customer loyalty. This contributes to a lower CAC and higher LTV over time. These sustainable tactics offer a more stable foundation for growth than relying solely on paid channels, which can become costly and competitive.

Want deeper insights into your lead sources to optimize your CAC? LeadPulse helps you understand where your leads and customers originate, empowering you to make informed decisions about your marketing spend. Learn more about how LeadPulse can transform your customer acquisition strategy.

Customer Acquisition Cost Calculator | Boost Your ROI

Use our customer acquisition cost calculator to optimize your marketing spend and improve ROI. Try it now for smarter growth strategies!

Marketing ROI Measurement: Proven Strategies for Results

Learn effective marketing ROI measurement techniques. Discover proven methods to prove your impact and boost resources today.